At John’s Crazy Socks, we have a mission to show what people with differing abilities can achieve. One way we carry out that mission is to advocate for policy, legislative and regulatory changes to support people with differing abilities. This week, John and Mark X. Cronin, our co-founders, met with two members of Congress to push for key legislative changes that advance the rights of people with differing abilities.

John and Mark focused on two issues:

- Eliminating the Sub-minimum Wage: This allows employers to pay people with a disability less than minimum age to someone simply because they have a disability.

- Enabling Employers to Contribute to ABLE Accounts: ABLE accounts allow people with a differing ability to save money and to shield it from benefit (e.g., SSI and SSD) calculations.

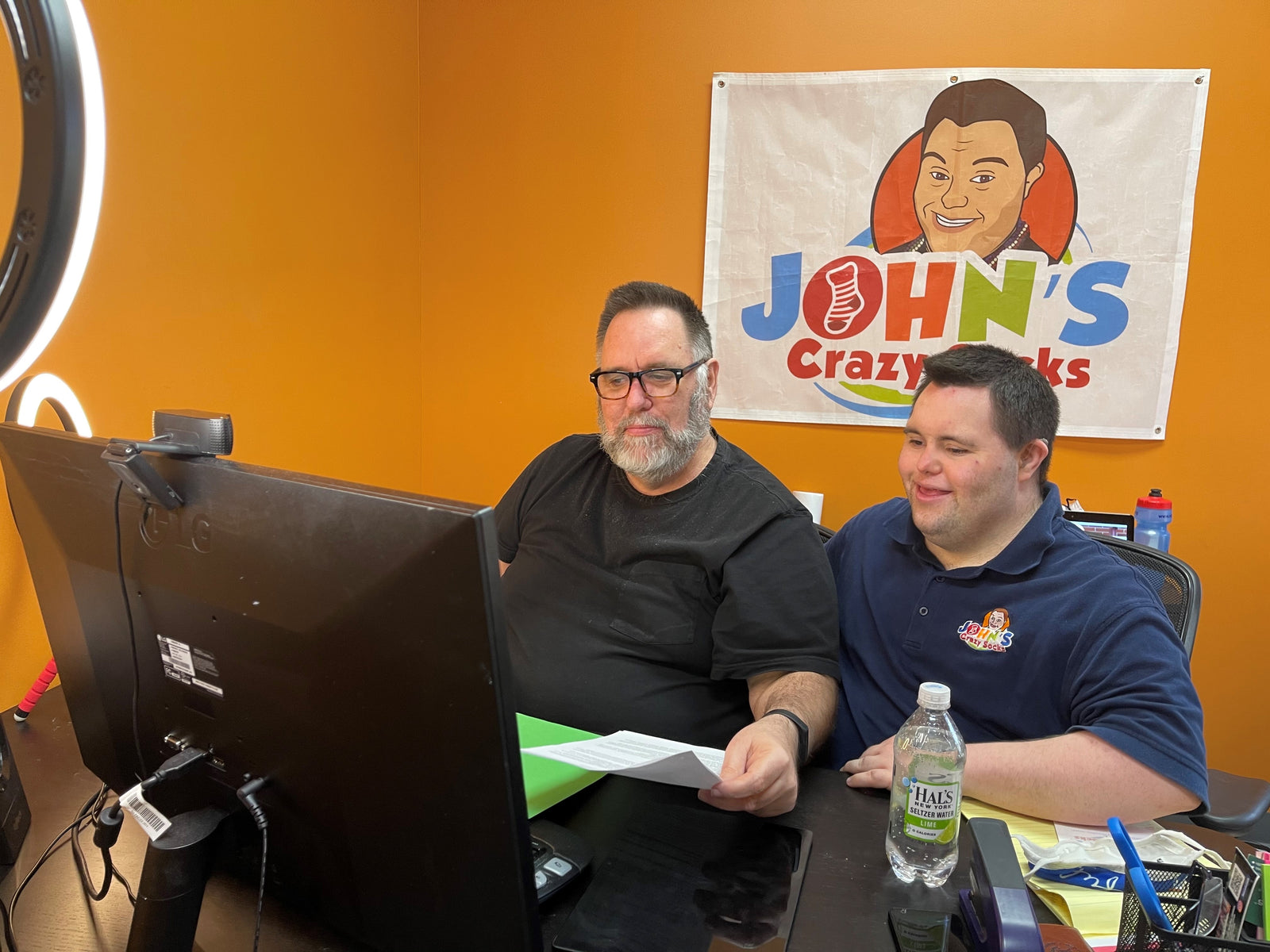

Mark and John are part of the CEO Commission for Disability Employment. This week, the leaders of the CEO Commission including John and Mark, met online with Congressmen Bobby Scott (VA-3) and Tom Suozzi (NY-3) to discuss key legislative changes. Congressman Scott is the Chair of the House Committee on Education and Labor. Congressman Suozzi, who represents the district where John‘s Crazy Socks operates and John and Mark live, is a key member of the Ways and Means Committee.

Eliminating the Sub-minimum Wage

Right now, there are as many as 400,000 Americans with disabilities being paid as little as $0.25 per hour for their work simply because they have a disability. The employers can do this because the Fair Labor Standard Acts of 1938 created a Sub-minimum Wage that allows employers to pay less than the minimum wage to people with a disability.

The Fair Labor Standard Acts of 1938 is a great piece of American legislation because it created the 40 hour work week, created overtime pay and eliminated child labor. However, it is not perfect. Section 14(c) of that act allows employers to obtain a certification to pay people with a disability less than minimum wage. These employers operate what is unknown as sheltered workshops.

We’ve come a long way in the 83 years since 1938. If John was born in that year, he likely would not have survived because the heart defect that he had repaired surgically in infancy never would have been repaired. And in those days, people with Down syndrome would have been placed in an institution. But that is not our world today. John has thrived and leads his own business, creating meaningful work not only for himself, but for others as well.

The National Down Syndrome Society (NDSS) reports that “only 5% of individuals who go into sheltered employment obtain employment. Additionally, more than 50% of individuals working under a 14(c) certificate earn less than $2.50/ per hour (GAO Report). This practice reinforces the stigmatic misconception that people with disabilities are less productive and creates an artificial competitive barrier to future employment opportunities.”

Congressman Scott has now introduced the Transformation to Competitive Integrated Employment Act (H.R. 2373) which has broad bi-partisan support. This bill would eliminate the sub-minimum wage and provide transition funding to sheltered workshops to move beyond the sub-minimum wage.

John and Mark stand with the CEO Commission and the NDSS in supporting the Transformation to Competitive Integrated Employment Act (H.R. 2373). We ask you to urge your Representatives to support this bill. You can take action here.

Enabling Employers to Contribute to ABLE Accounts

John’s Crazy Socks has supported the use of ABLE accounts because they make such a difference to people with differing abilities, particularly those who ae employed. Over half our colleagues have a differing ability so this is very important to our business. In November 2019, we held an event with New York State Comptroller Tom DiNapoli to promote the use of ABLE accounts.

We want employers to have the ability to contribute to ABLE accounts the same way they can contribute to a 401(k) account. These changes are embedded in the ABLE Employment Flexibility Act. This is an equity issue.